The impact of Microsoft’s finance head on the company

Microsoft Keeps Its Finance Head

The role of a finance head in a company is critical to maintain stable finances and ensure that the company remains financially sound.

Microsoft, as one of the biggest technology companies in the world, has kept its finance head in place for many years, and we will be looking at the positive impact this has had on the organisation.

Overview of Microsoft’s Finance Head

The Microsoft finance head is responsible for overseeing the company’s financial operations and steering the strategic direction of investments. The finance head is appointed by the CEO but serves all of Microsoft and reports to the Board of Directors. He/She is accountable for providing sound financial advice, proactively presenting solutions to management challenges and ensuring that Microsoft’s finances remain healthy.

Microsoft’s finance head ensures an integrated and effective set of policies and procedures are in place and provides reliable financial information to internal departments, external stakeholders and investors. The finance head must be proficient in understanding both existing operation financing and emerging economic trends that may affect the firm’s investments or services.

The technology giant has had many renowned heads of finance over its 37 years as a publicly-traded company — from Reid Hoffman to Chris Liddell — who have helped shape this organisational role over time. It could be argued that these top executives have had a major impact on the success of Microsoft’s development and current competitive market position due largely to the wealth of knowledge and successful investments they bring to their roles.

Impact on Business Strategy

Keeping Microsoft’s finance head, Amy Hood, in her current position reflects the company’s commitment to long-term planning and financial discipline. With Hood in the lead, Microsoft can maintain its focus on using data to inform its decision-making and strengthen its financial position.

Let’s take a closer look at the impact of Hood’s leadership on Microsoft’s business strategy.

Financial Performance

Microsoft’s finance head, Amy Hood, is responsible for billing, accounting, treasury, and financial planning and analysis. She was appointed to her position of executive vice president and chief financial officer in 2013 by Satya Nadella, Microsoft’s CEO. With over two decades of finance experience from Goldman Sachs to Microsoft’s go-to-market groups, she has brought a renewed focus on customer relationships and optimised operations for more efficient profits.

Hood has strengthened the company’s financial position through innovative investments such as reshaping its portfolio towards high value markets and its business model towards cloud-based services. In addition, she has instituted a “One Microsoft” philosophy emphasising cross divisional collaboration. This approach is focused on bringing unity within the organisation by better allocating resources among multiple departments while staying ahead of industry trends through continued idea sharing via dialogues with product leaders from all divisions.

Her vision for Microsoft includes cutting costs while driving innovation and technology adoption through acquisitions and strategic partnerships with leading industry players for competitive advantage in the marketplace. This means actively investing in research & development to create new markets with higher margins by pushing products into new markets such as enterprise software for analytics and AI technologies which stimulate share price growth despite slower organic growth rates due to commoditization of existing products in old markets.

Under Hood’s financial leadership, Microsoft could post positive results during the coronavirus pandemic even when pitted against most Apple rivals whose share prices tumbled due to weakened demand worldwide. Her efforts have improved their business model’s flexibility while maintaining profit margins despite external pressures such as market uncertainties thanks to cost savings initiatives like improved production processes enabling a leaner supply chain system.

Shareholder Value

Microsoft’s finance head, Amy Hood, has considerably impacted the company’s strategy to create shareholder value. Hood has implemented several initiatives that have allowed Microsoft to increase cash flow and dividends to shareholders. Key among her strategies have been cost-saving measures, such as reducing expenses and layoffs and investing in sustainable business practices.

Under Hood’s guidance, Microsoft has implemented a series of dividend payouts for shareholders, up 15.9% since 2016. Additionally, through acquisitions and divestitures of businesses not deemed core to the company’s mission, the company has been able to save money and operate more efficiently. In response to the Covid-19 pandemic, she also spearheaded an aggressive capital repurchase program initiated in April 2020 – buying back $45 billion worth of shares in 2020 alone – and executing several debt issuances which provided additional liquidity and flexibility during a difficult economic period.

Most importantly, Hood helped craft Microsoft’s culture focused around a “One Microsoft” strategy which streamlined its businesses into a more cohesive whole allowing greater efficiency even as the workforce was being downsized due to layoffs or divestitures. This new focus combined with cost-savings efforts enabled greater returns for shareholders than ever achieved by any previous technology company with nearly 50% gains on stock price from 2015-2019 alone despite market drops across the industry during that period.

Corporate Governance

The importance of corporate governance in any company’s success cannot be overstated, and when it comes to Microsoft, the appointment of a new finance head brings significant implications. The finance head is responsible for monitoring and controlling the financial activities of a corporation. In addition, this individual has extensive authority over pursuing financial goals, planning and implementing strategies across various departments, and reporting performance results. As such, they play an integral role in ensuring that the organisation’s vision and culture are implemented with clarity.

In addition to managing finances, the finance head ensures that all operations comply with applicable regulations. They also lead efforts in taking risks that help the organisation grow and expand its offerings or operations into new markets. Microsoft’s decision to appoint a new finance head will help ensure compliance with applicable laws and regulations while optimising the company’s financial performance. With someone like this at the helm it will enable sound management of corporate resources and guide on strategic matters that support long-term business growth.

Impact on Business Operations

When Microsoft announced the appointment of its new finance head, Amy Hood, many in the business world welcomed the news with optimism. Amy Hood brings with her extensive experience and knowledge of the financial industry, and there is no doubt that her appointment will positively impact the operations of Microsoft.

This article will explore how her leadership and expertise affect Microsoft’s operations.

Cost Reduction Strategies

Microsoft’s finance chief has had a major impact on the company’s operations. By leveraging the widespread use of technology to streamline processes, reduce cost and improve efficiency, Microsoft has achieved cost savings across the board.

The finance team at Microsoft has implemented cost reduction strategies to bring expenses under control while still delivering quality products and services. These strategies include leveraging digital capabilities and automation, conducting regular internal audits, outsourcing non-core activities, implementing strategic sourcing initiatives and using more efficient materials production methods.

Additionally, Microsoft has formed partnerships with outside vendors to secure volume discounts on supplies and negotiate better rates for services like infrastructure support or software development. To further reduce spending, competitive bids are also sought for large contract awards like consulting engagements or specifying new IT systems.

Finally, Microsoft leverages its data centres worldwide to minimise costs associated with energy usage by reducing travel distances for particular tasks or storing data in regions closer to specific customers. Through these efforts and other measures initiated by the company’s finance head, Microsoft has realised continuous savings across operations over an extended period.

Cash Management

In an era of ever-evolving technology, improved security measures and the changing needs of customers, it is more important than ever for businesses to engage in sound cash management practices. Microsoft’s finance head, Amy Hood, has had an undeniable impact on the company. She has implemented a better approach to managing cash flows and managing financial risks to create additional value for the company.

In her two years at Microsoft, Hood has improved financial organisation, optimised core accounts receivable processes, and identified key strategic investments to strengthen capital investments in areas that build long-term shareholder value. Hood also implemented a global currency hedging program to reduce foreign exchange risks and increase Microsoft’s competitiveness in international markets.

The result of Hood’s efforts has been tremendous improvements in cash flow management and reduced spending while still allowing Microsoft to maximise returns on its investments. Additionally, she was instrumental in implementing a system that better aligns revenue recognition systems with customer demands while providing insight into future customer demands thus providing greater flexibility in Microsoft’s accounting processes. This system further reduces costs related to accounts receivable ageing processes while improving accuracy around customer billing information through improved data capture tools and analytics capabilities.

Risk Management

Microsoft appointed a new head of finance, Amy Hood, in 2013. With her appointment, Microsoft strengthened its emphasis on risk management and financial planning. As part of Hood’s strategic plan for the organisation, she implemented several innovative methods to create cost efficiencies, such as entering into long-term debt financing arrangements and cutting down on dividends.

Hood also developed a comprehensive financial strategy for the company, which included better managing customer relationships and business units. This strategy allowed Microsoft to enter new markets, develop novel products and expand existing products through strategic collaborations. In addition, Hood identified areas where improved risk management and financial controls were needed and implemented new processes to enable stronger capital allocation decisions.

At the same time, Hood sought to attract high calibre talent in finance and stock market analysis by stressing the sustainability of Microsoft’s business model while developing corporate strategy around innovation. The emphasis on disclosure also helped improve investor confidence as people heard directly from senior executives about upcoming changes at the company.

Under Hood’s oversight, Microsoft experienced rapid expansion in its cloud regions; deployed Office 365 at a global scale; acquired LinkedIn; built up a presence in gaming; launched AI services like Cortana; moved into device design with the ability to bring innovative technology directly to customers; implemented machine learning capabilities across software platforms; opened up an enterprise app store; addressed cybersecurity threats with advanced Windows protection enhancements; rolled out Azure Machine Learning services for developers; launched mobile-first Office 2016 apps foundational components for HoloLens holographic computing platform; increased digital campaigns by launching self-serve tools for social network advertising customers worldwide.

Additionally, all these efforts furthered Amy Hood’s impact on Microsoft’s risk management practices by improving capital allocation decisions across all the corporation, leading to improved value creation through shareholder returns.

Impact on Innovation

Microsoft has recently announced that its finance head, Amy Hood, will remain with the company through 2021, which signals the tech giant’s dedication to innovation and growth. Amy Hood has been with Microsoft since 2002, and her expertise and leadership have helped drive Microsoft’s success over the years.

Let’s look deeper at the impact of Amy Hood on Microsoft’s innovation efforts.

Investment in R&D

Throughout her tenure at Microsoft, finance chief Amy Hood has been credited with driving a shift away from short-term financial metrics and focusing on long-term metrics emphasising strategic investments in research and development (R&D). Hood has argued that increased R&D spending was needed if Microsoft hoped to remain a leader in technology innovation.

Hood’s philosophy around R&D spending is rooted in the belief that continued product development ensures an organisation’s ability to compete. In addition, she views R&D expenditures as crucial investments in the future innovation and productivity of the company.

As a result, Hood’s strategy has meant more resources being allocated towards advanced technologies such as artificial intelligence (AI), cloud computing, data analytics and quantum computing. This focus on long-term investment enables Microsoft to maintain its edge over competitors in emerging markets and develop differentiated products with superior value propositions for current customers.

Hood melds these two elements: financial oversight coupled with strategic investments from traditional balance sheet accounting with an understanding of how new technologies can unlock competitive advantages for businesses. As such, her views on investment have enabled Microsoft to position itself for sustained success going forward and challenge other tech companies to innovate more rapidly or risk market share losses as Microsoft leverages its size and scale within AI, cloud computing, data analytics, marketing intelligence and quantum computing markets.

Mergers and Acquisitions

Under the leadership of Microsoft’s finance head, Amy Hood, the company has become a powerhouse in mergers and acquisitions (M&A). During her tenure, she drove billions of dollars into restructuring investments, integrating new businesses to create new products and solutions for customers.

Since 2014, Microsoft has led over 160 unique M&A deals across its various divisions. With Hood as CFO since then, she has overseen many acquisitions from small companies like To-Increase to larger ones like LinkedIn and GitHub. As these M&A deals connect different entities, Microsoft hopes to boost its presence in various markets and capitalise on the resources provided by other companies.

In addition to growing the business through mergers and acquisitions, Hood has also put much effort into creating a more innovative culture at Microsoft. Under her guidance, Microsoft created a new organisational structure that incentivizes staff to come up with new ideas and develop impactful projects. This structure has helped employees while enabling innovation by helping existing teams explore ideas beyond their scope.

Through visualising potential synergies in mergers and acquisitions and establishing a culture that rewards innovation at work, Amy Hood’s actions have established an environment conducive towards creating sustainable growth for Microsoft not just in the present but also far into the future.

Strategic Partnerships

The impact of Microsoft’s finance head on the company has been multi-faceted, but one of the most significant areas of influence has been in driving strategic partnerships. As the company’s CFO, he has been instrumental in developing relationships with Microsoft’s various technology partners, strengthening future collaborations and revenue streams.

In 2020, Microsoft announced a strategic partnership with Nvidia to develop artificial intelligence and data sciences solutions. Through this collaboration, the companies have sought opportunities to improve existing technologies and unlock new capabilities for AI applications. Similarly, Microsoft has spent time forming partnerships with Sony, Walmart and Deloitte that focus on supply chain optimization solutions using its cloud platform Azure.

To provide integrated experiences for customers on any device or platform available today, Microsoft has developed multiple partnerships across the industry including software vendors such as Adobe and Oracle and hardware manufacturers such as Lenovo and HP. In alignment with its mission to provide virtually seamless integration across all its products – Windows 10 IoT Core Services helps ensure that when customers use any IoT device, they can seamlessly connect it with their other services powered by Azure or Office 365.

Without the guidance of a seasoned finance leader such as Satya Nadella at the financial helm of Microsoft, these strategic partnerships may not have formed effectively or within such a short period. The CFO role is often undervalued but having an experienced leader who can form alliances with other companies leads directly to improved efficiency and cost savings through sustainable tangible investments proving itself immensely beneficial in the long run for any company looking towards achieving greater growth potential in their industry sector.

tags = Microsoft Corp., 5,000 people in its finance team, intelligence, bots, the cloud, data lakes and machine learning, hrncirik microsoft finance exceltrentmann wall streetjournal, hrncirik modern finance ai wall streetjournal

Cabinet Door Thicknesses For Mass-Produced Doors

Cabinet Door Thicknesses For Mass-Produced Doors  Building The Deck Frame

Building The Deck Frame  Bricks That Are 8in. x 4in

Bricks That Are 8in. x 4in  Benefits Of Wiring Your Own Backyard Lighting

Benefits Of Wiring Your Own Backyard Lighting  Benefits Of Using The Green Stuff In A Planter

Benefits Of Using The Green Stuff In A Planter  Average Cost Of Materials To Build A House In Florida

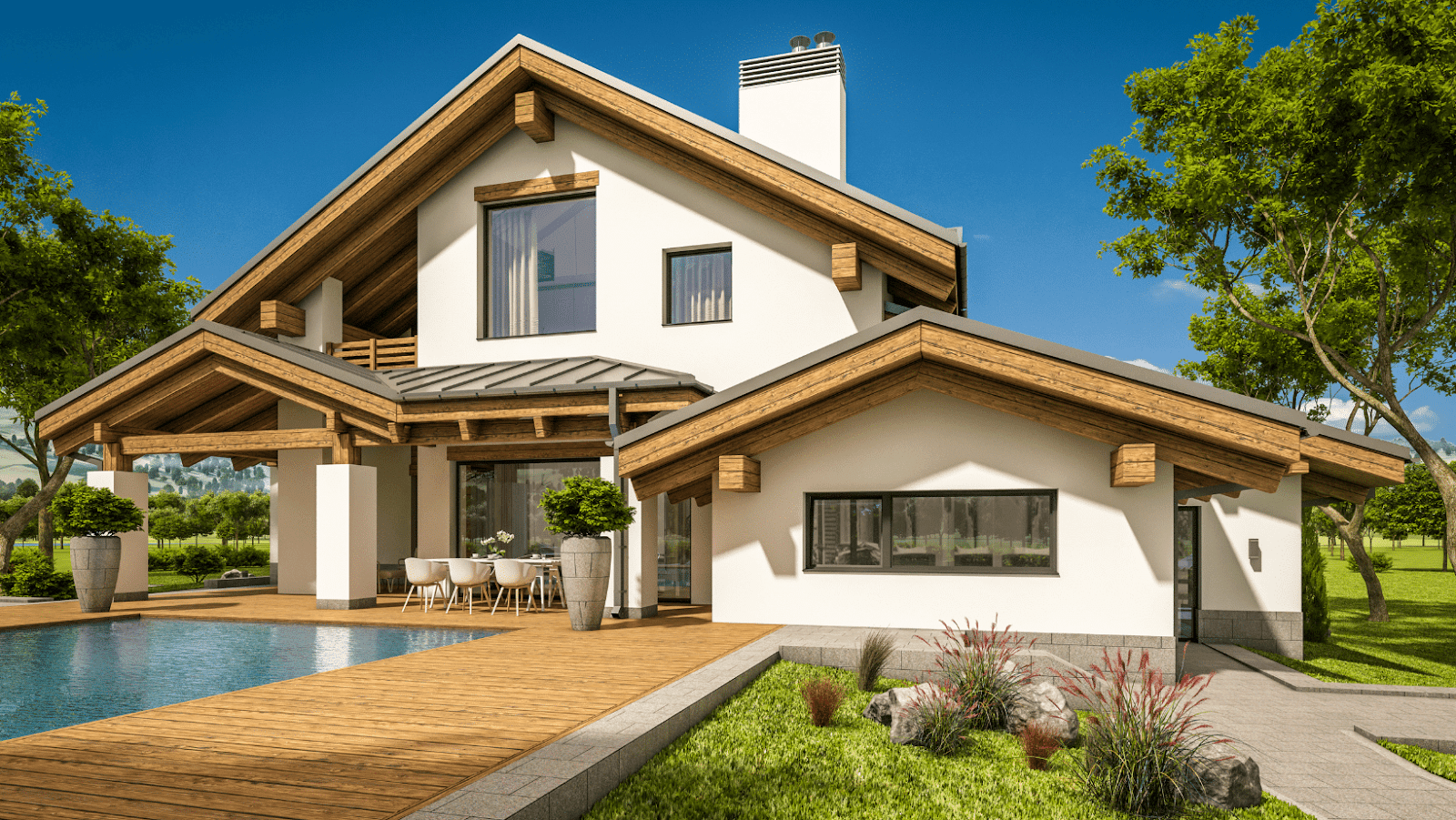

Average Cost Of Materials To Build A House In Florida