Why Tencent-Backed Linklogis Rises 9.9% in Hong Kong Debut

Tencent-Backed Linklogis rose 9.9% in its Hong Kong debut on Wednesday, January 13, 2021, driven by demand from technology-focused investors. Linklogis is China’s leading logistics provider backed by tech giants Tencent, Sequoia and Hillhouse Capital.

The surge in Linklogis stock indicates investors’ confidence in the tech sector in the new year. We will now explore the reasons for Tencent-backed Linklogis’ stellar performance.

Tencent-Backed Linklogis Rises 9.9% in Hong Kong Debut

Tencent-backed logistics firm Linklogis International Holdings debuted on the Hong Kong Stock Exchange on October 28, 2020, trading at HK$2.88 ($0.37) per share and closing 9.9% higher at HK$3.18. The company had its IPO two months earlier at a final offer price of HK$2.7 per share to raise almost HK$2 billion ($259 million).

Headquartered in Shenzhen, China, Linklogis is a leading technology-driven one-stop logistics service provider offering warehousing, transportation, and financial loan services to the logistics industry in the Greater China region. The company’s main service offerings are focused on the e-commerce markets of Mainland China and Hong Kong with a robust suite of technology solutions designed to make logistics smarter and simpler for customers in those regions.

Linklogis also specialises in providing supply chain financing services by partnering with financial institutions to provide businesses access to capital through asset factoring. By leveraging its integrated network of trust signatures and its technical capabilities, Linklogis can provide real time visibility into delivery status updates thus providing an enhanced customer experience while ensuring collateral security for lenders throughout the supply chain lending process.

Linklogis became publicly traded after the listing process began in January 2020 with Tencent being one of its largest shareholders with an 18% stake which has made it one of the key drivers behind Linklogis’ IPO success since investors are viewing this as a show of faith from such an influential tech giant.

Reasons for the Rise

Tencent-Backed Linklogis experienced a 9.9% increase in its Hong Kong debut. Linklogis had such a successful first day of trading for a few key reasons. This article will explore the factors contributing to the Linklogis 9.9% rise in its Hong Kong debut.

Tencent’s Investment

Linklogis, a Chinese supply chain finance firm backed by tech giant Tencent Holdings Ltd. (OTCMKTS: TCEHY), had a successful market debut today, closing 9.9% higher than its IPO price HK$2.52 (or $0.32) per share in the Hong Kong Stock Exchange.

Linklogis’ favourable performance can be largely attributed to Tencent’s investment and significant influence in the company. Its backing as China’s leading integrated services Internet platform is a strong vote of confidence for this specialty finance firm. Moreover, it has investors anticipating strong growth from its performance in the future.

Tencent first took an equity stake in Linklogis in July 2018 for HK$888 million ($114 million). This investment enabled Linklogis to acquire deeper roots in China’s supply chain business landscape, harnessing Tencent’s well-established customer base and digital resources to rapidly grow its network of services such as trade receivables financing, open account receivables factoring and payment services across industries such as shipping and e-commerce logistics.

In addition to providing funding, Tencent also helps Linklogis explore financial technology solutions as part of their collaboration efforts by coming up with innovative ideas that range from tracking goods delivery on their WeChat mini program MyDelivery to utilising their data analytics capabilities for better investigation risk management audit processes via X-Ray Credit Assessment System. Furthermore, Linklogis is leveraging other customer-centric features provided by the tech giant such as WeChat Pay and social media marketing opportunities on WeChat Moments to reach more than 1 billion monthly active users on Tencent’s platform anytime.

All these initiatives are designed to enhance visitor experiences online or offline, promote product offerings more efficiently or engage consumers with brand messaging omnichannel — all factors that have helped raise investor confidence in Linklogis during its Hong Kong Stock Exchange debut today.

Increasing Demand for Logistics Services

The company’s listing follows a period of rapid growth for the logistics sector in China, driven in part by the global pandemic and resulting shift to online shopping. While traditional e-commerce companies such as Alibaba Group Holding Ltd. and JD.com Inc. have invested heavily in logistics, their focus has sharpened over the past year due to heightened service demand.

Linklogis’ operating environment has also been bolstered by recent policies aimed at streamlining regulations and promoting innovation within the supply chain sector. These policies emphasise cross-border linkages and adopting modern technologies such as AI, automation, and data analysis to enhance operational efficiency and effectiveness.

Linklogis anticipates meeting growing customer demand with integrated services including warehousing, delivery, express pickup/delivery, parcel sorting/consolidation management, supply-chain finance solutions and other value-added services such as international freight forwarding. In addition, the company’s forwarder licence (Type A), its national-level customs brokerage qualifications (Type B), and its proximity to key trade hubs throughout the region puts it in an advantageous position compared with other players in the market.

Impact of the Rise

Tencent-Backed Linklogis began trading on Hong Kong’s stock exchange on Tuesday, and the firm saw its shares surge by 9.9%. This significant increase in the firm’s stock price has had a significant impact on the markets, for both investors and analysts.

In this article, we analyse the effects of the rise in Linklogis’ stock price and its implications for the future.

Positive Impact on Tencent’s Stock Price

The successful initial public offering (IPO) of Tencent-backed logistics firm Linklogis on the Hong Kong Stock Exchange has been seen as a positive sign for technology and e-commerce stocks. As one of China’s biggest technology firms, Tencent’s stock has been boosted since the 9.9% surge in Linklogis’ listing.

This impact likely comes from investors seeing this as a favourable opportunity to gain further exposure to companies operating in China’s logistics and e-commerce sectors, two of the fastest growing economies in 2020. This optimism is reflected in analysts expecting Tencent’s market capitalization to increase by an estimated 15% following the successful IPO launch.

As China transitions into its next five year plan – which includes increasing investment into logistics activities – it appears that not just Tencent but other technology companies could benefit from this shift. Moreover, the potential for even larger growth could be coming with many companies beginning their new five year plans – analysts have projected that overall integration within global markets will continue to grow rapidly over the next few years where linklogistic service may increase even more while understanding global markets better.

Positive Impact on Hong Kong Stock Market

The successful initial public offering (IPO) of Chinese warehousing and logistics operator Linklogis Holdings in the Hong Kong Stock Exchange (HKEX) positively impacted the Hong Kong stock market. The CK Hutchison-backed transport and logistics company opened at 9.9% above the issue price of HK$7.44, rising to 10.3% above the issue price in the morning session.

Linklogis Holdings is a leading player in mainland China’s fast-growing and highly competitive transportation and storage services industry. It is supported by an impressive investor base, including Alibaba Group Holding Ltd, Tencent Holdings Ltd, Baidu Inc and China Merchants Group Ltd. Its listing will likely encourage more tech-savvy companies to choose HKEX venues instead of Wall Street or other listing locations.

The successful launch of Linklogis’ shares should benefit Hong Kong’s main index Hang Seng and add a much needed dose of confidence for investors looking for good returns without excessive risks. As such, investors have responded positively to this retail focused IPO due to its strategy with large institutions such as banks and hedge funds involved in the placement. Moreover, traders received bonus from link logis’ plan to buyback shares from the open market four times within the next 18 months, which would further bolster prices near term at least until completion of these timed buybacks within that period is completed.

tags = Tencent-Backed, Linklogis, Rises 9.9%, Hong Kong Debut, Tencent Holdings Ltd, tencentbacked hong ipo hk17.58bloomberg, disappointing listings in the city

Cabinet Door Thicknesses For Mass-Produced Doors

Cabinet Door Thicknesses For Mass-Produced Doors  Building The Deck Frame

Building The Deck Frame  Bricks That Are 8in. x 4in

Bricks That Are 8in. x 4in  Benefits Of Wiring Your Own Backyard Lighting

Benefits Of Wiring Your Own Backyard Lighting  Benefits Of Using The Green Stuff In A Planter

Benefits Of Using The Green Stuff In A Planter  Average Cost Of Materials To Build A House In Florida

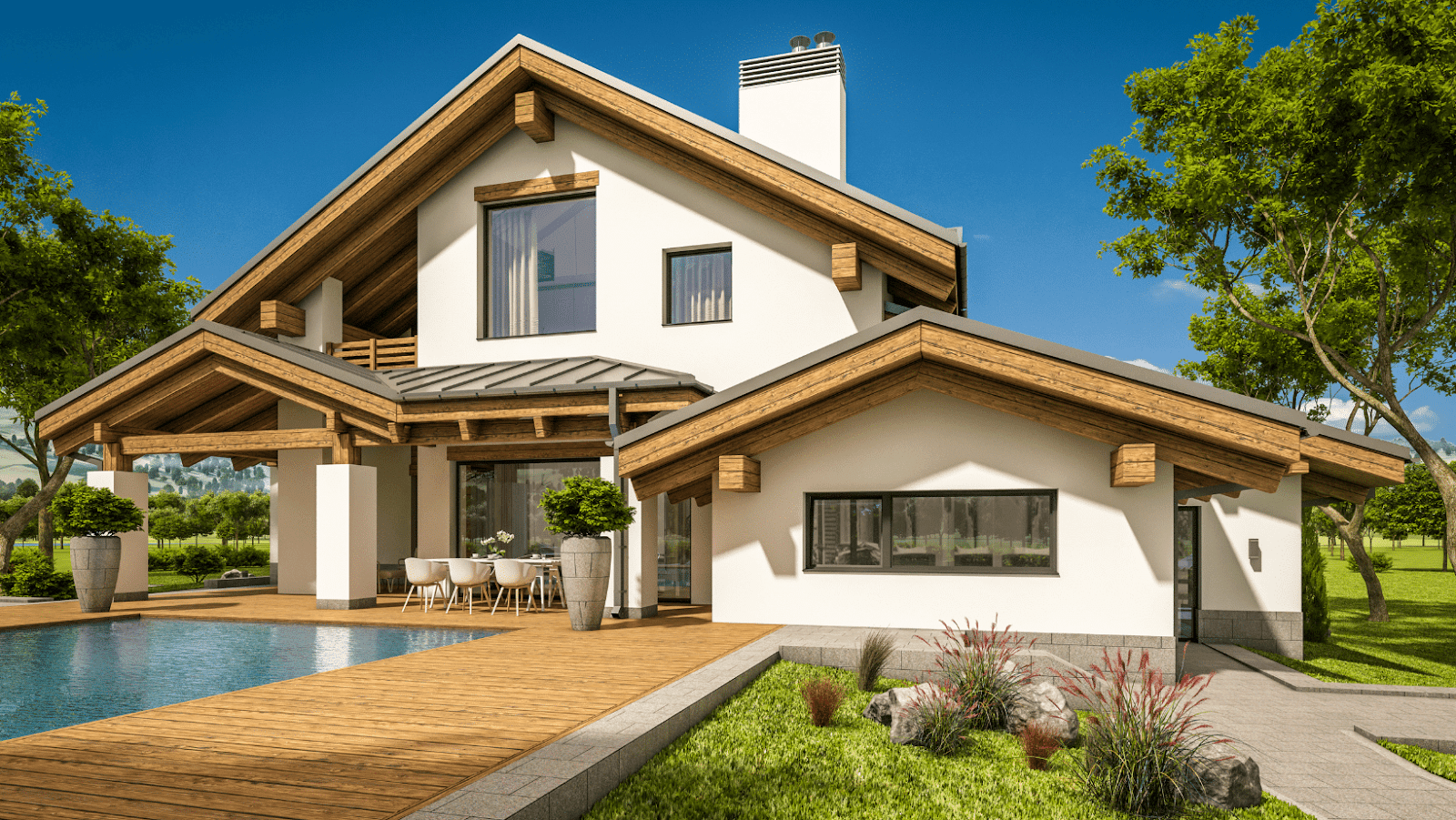

Average Cost Of Materials To Build A House In Florida